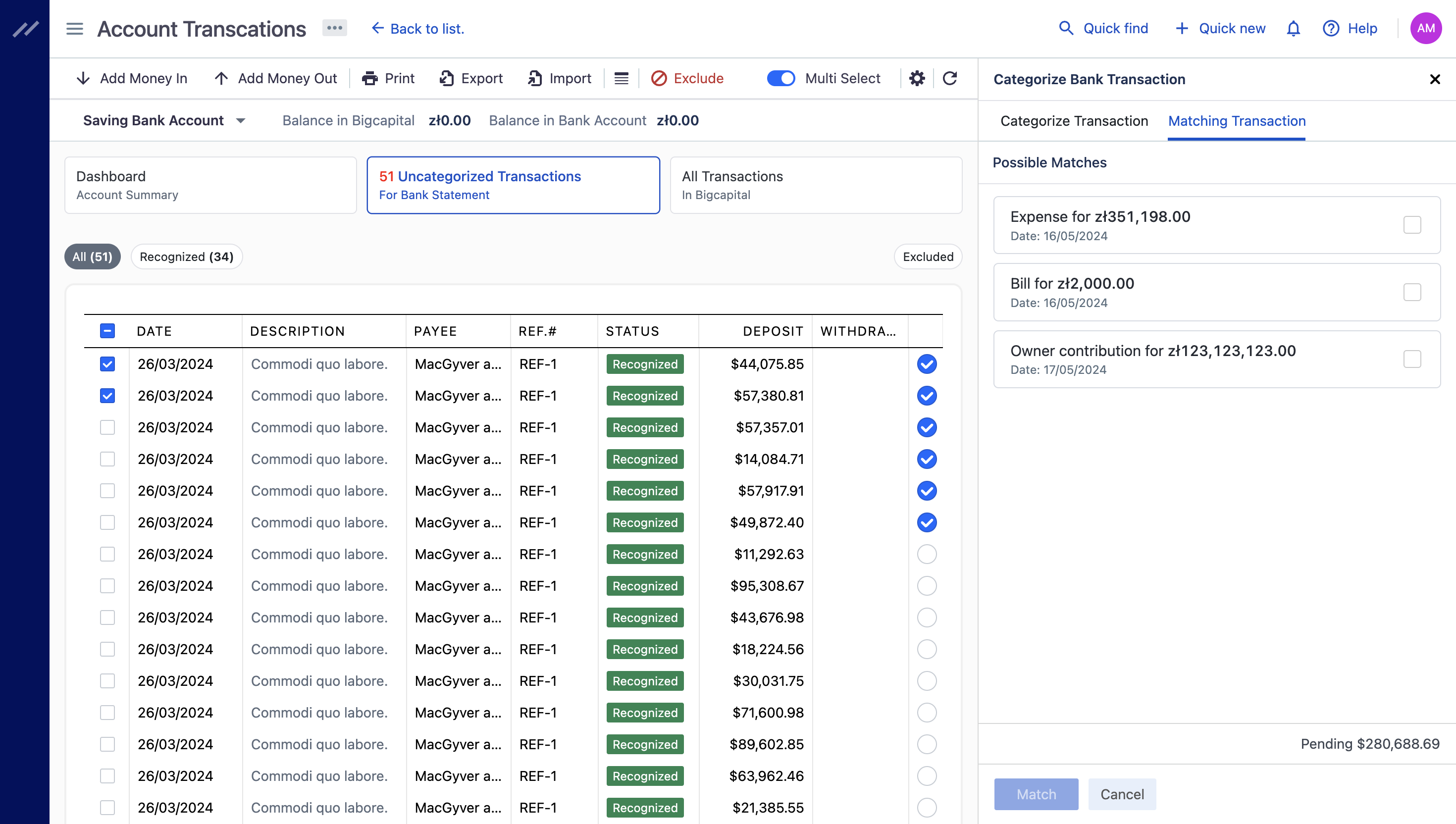

Multi-select transactions categorization

Today, we are excited to announce a major release with significant improvements to our banking service. One of the most important features is the ability to categorize or match multiple bank transactions with a single Bigcapital transaction at once.

Additionally, we have introduced bulk transactions excluding and un-excluding. In the banking service, you can now perform actions for multiple transactions, such as deposits or withdrawals, at once. This is especially useful if you have hundreds or thousands of duplicated transactions. Excluding actions allows you to eliminate duplicated transactions from your statement and ensure they are not included in the organization's financial statements.

Pause, resume or stop bank account connection.

When you connect your bank account Bigcapital syncs all the bank transactions to Bigcapital, now you can decide to pause or resume the automatic transactions syncing temporarily for any specific bank account for better control or disconnect the bank account disconnection entirely.

When disconnecting the bank account connection you need to verify and connect the bank account connection again. If you disconnect an account from online banking, your existing accounting data won't change. You can always reconnect it anytime to start sync transactions again.

Record overpayments as a credit.

When a customer pays more than the invoiced amount or pays in advance in some cases, the excess payment can be recorded as a credit. This credit can then be applied to future invoices, ensuring accurate financial records and automating the reconciliation of customers and vendors accounts

Billing page

With the new improvements in the billing page, you can upgrade the subscription plan, change the payment method or even pause the subscription and view the current status of your organization's subscription.